In today’s competitive business environment, maintaining healthy cash flow is critical to long-term success. When faced with slow-paying customers or delayed receivables, many businesses feel pressure to offer quick-pay discounts as an incentive. This tactic—commonly referred to as blind discounting—may appear to offer a quick financial fix. However, it often results in reduced profitability, weaker customer expectations, and long-term financial strain that far outweigh any short-term benefits.

Blind discounting can severely undermine your profit margins. For example, offering a 2% discount on invoices for early payment might seem minor, but when annualized, it equates to a financing cost of over 24%. That’s a hefty price to pay, especially when far more cost-effective options are available. Rather than helping your business, blind discounting can quietly chip away at your bottom line and erode the value of your product or service in the eyes of your customers.

In addition to lost revenue, businesses that regularly rely on discounts to get paid faster often train their clients to expect lower prices or delayed billing as a norm. This weakens your pricing power and can shift the customer relationship from one based on mutual value to one driven solely by financial concessions. In many cases, businesses find themselves locked in a cycle of offering deeper discounts just to maintain the same level of customer loyalty.

Even worse, blind discounting doesn’t guarantee results. You might offer a discount expecting early payment, only to find that customers still delay their payments—or simply take the discount and pay late. Without predictable cash flow or payment behavior, businesses are left in limbo, facing cash gaps without any strategic financial support. That’s why it’s crucial to explore alternatives that provide real cash flow solutions without diminishing your value.

What is Blind Discounting?

Blind discounting occurs when businesses offer customers arbitrary early payment discounts (e.g., 2% off if paid within 10 days) without fully evaluating the true cost of that discount. On the surface, it may appear as a smart incentive to encourage faster payments. But in reality, it can significantly erode profit margins and undervalue the goods or services provided.

Why Blind Discounting is a Poor Financing Strategy

A Smarter Alternative: Financing with TrueCore Capital

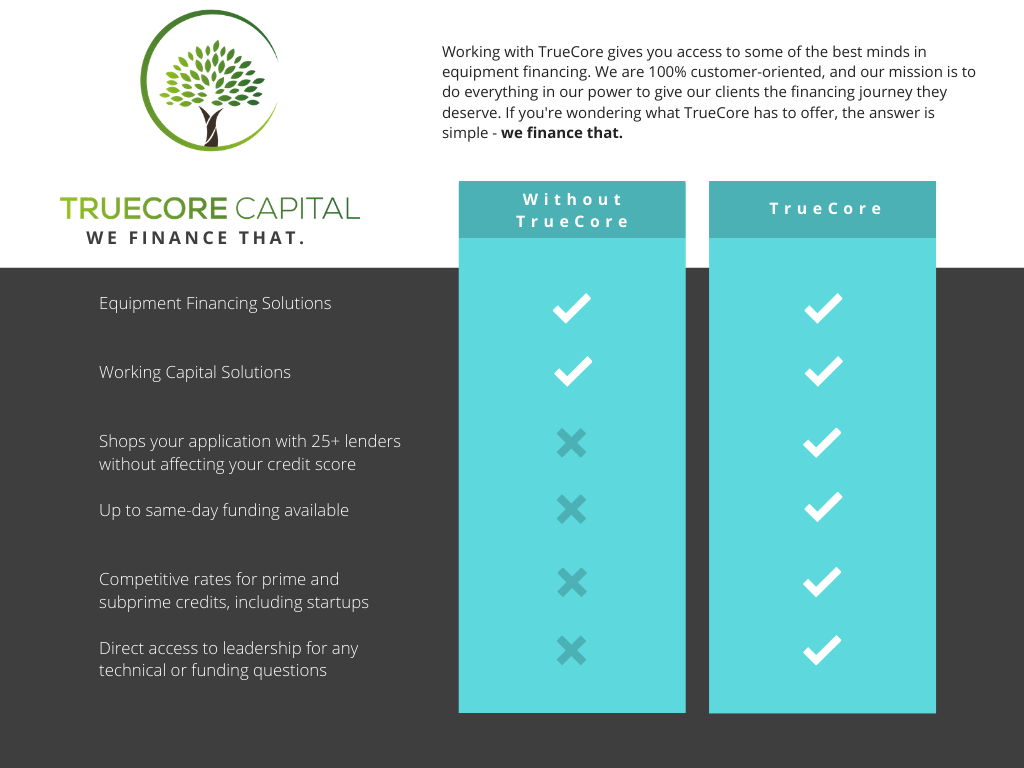

Rather than sacrificing margins for unpredictable returns, TrueCore Capital offers tailored financing solutions designed to preserve value while improving cash flow. Here’s how TrueCore can help:

Don’t Leave Money on the Table

In an effort to get paid faster, too many businesses unknowingly give away their profits through poorly considered discounting practices. Blind discounting may seem like a harmless solution, but it often leads to lost revenue, weaker customer expectations, and unstable cash flow.

TrueCore Capital empowers businesses with smarter, data-driven financing that keeps operations running strong—without sacrificing value. Let us help you protect your bottom line and access the capital you need to grow.

Ready to start your journey? Apply Now! Click Here to Fill out our Online Application